option to tax residential property

Opting to tax is quite easy. The property tax is an ad valorem tax meaning that it.

I Rent Property In Arizona And Need To Apply The Appropriate Tpt Rates The Auto Tax Function Doesn T Provide A Residential Rental Property Option Any Work Arounds

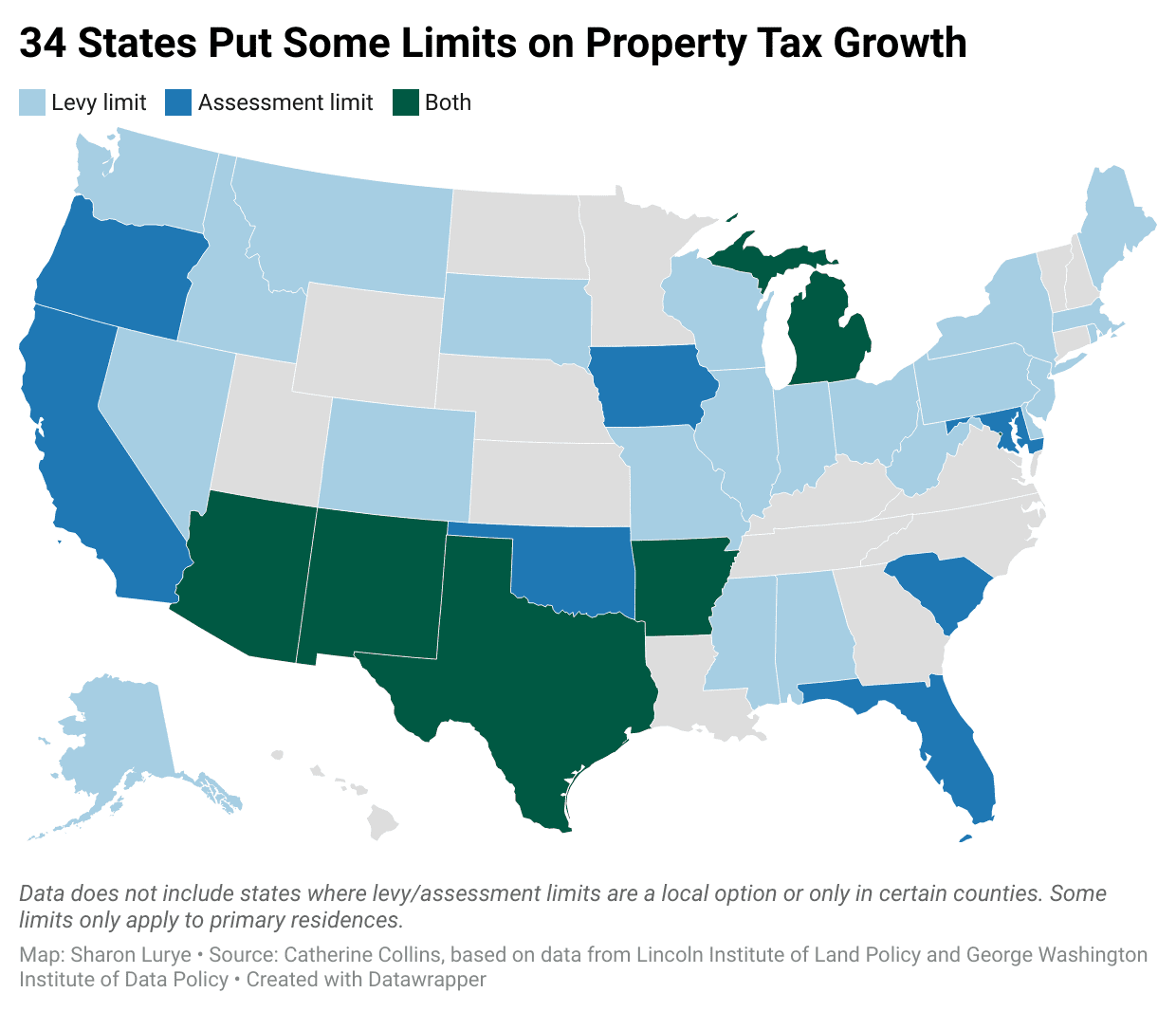

In order to calculate your real estate taxes multiply your homes assessed value by the levy.

. Option to tax generally has no effect on the residential properties although you can opt to tax residential properties in theory. And if a residential property is exempt through the. Meanwhile there is no need to opt to tax if the commercial premises are to be developed into a residential home or if the building is to be used by a charity.

The breweries have been selling off unused properties for several years now and you can often find a decent property in the price range 100000 - 200000 depending on size. Option to tax lettings. A supplemental tax on the conveyance of residential real property or interest therein when the consideration is 2 million or more.

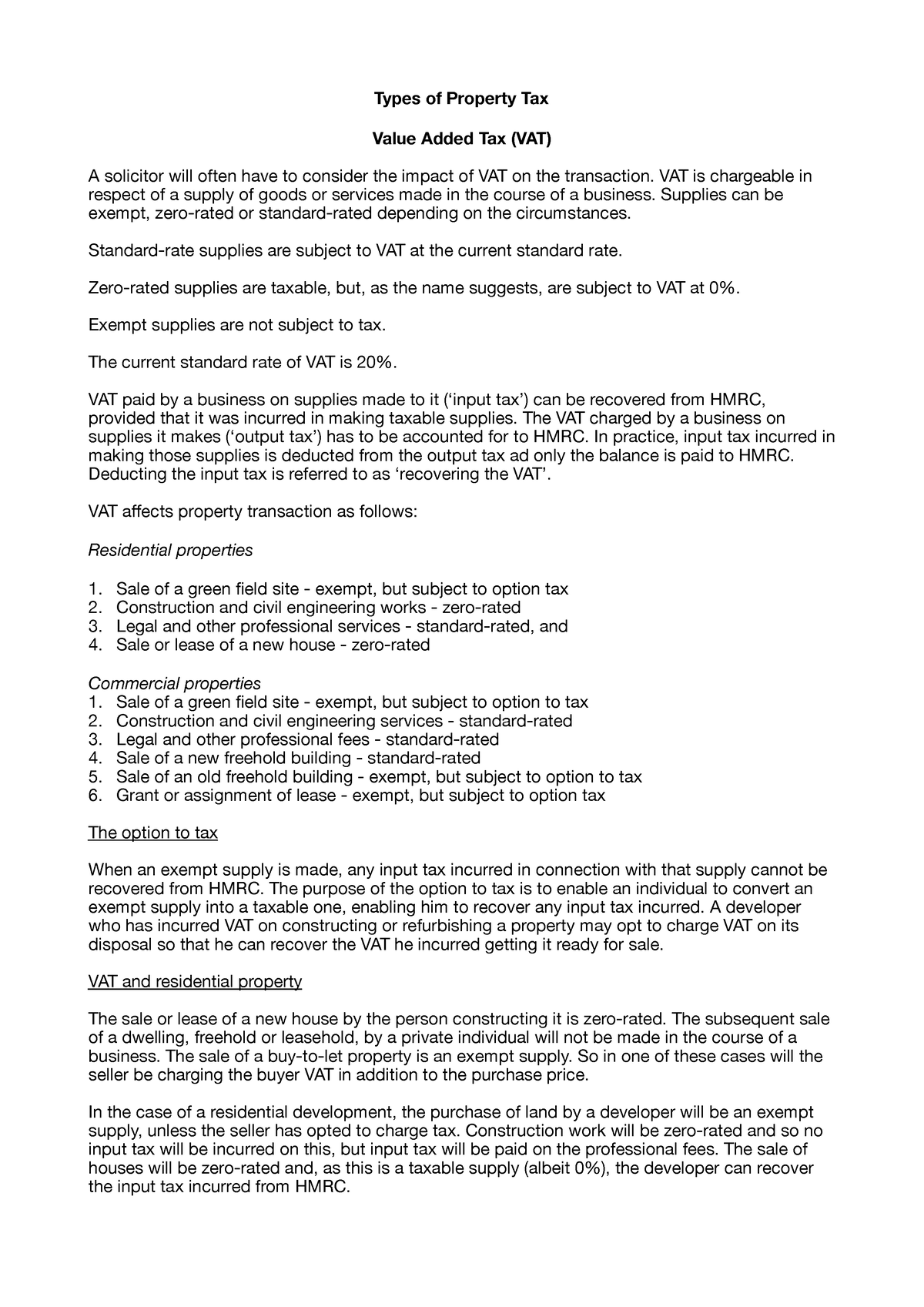

The sale or letting of a property is in most cases exempt VAT free by default. However it is possible to apply the option to tax OTT to commercial property. The tax rate is an incremental rate between 25 and 29.

Others are partially exempt such as. How to get an option to tax Once. You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC.

However as a landlord you can opt to tax the letting of certain properties. When you let the property to residential tenants or charity the. But leasehold sales are exempt subject to the option to tax see Opting to tax land and buildings VAT Notice 742A.

One of the most common misapprehensions is that when a business opts to tax a property its the property thats opted and the option carries over to a new owner if its sold. Assume your home is worth 200000 and your property tax rate is 4 you will be. It is and always has been a residential property but for some reason the council has opted to charge VAT on the sale price.

You can opt to tax one. The letting of a property is exempt from Value-Added Tax VAT. Option to tax generally has no effect on the residential properties although you can opt to tax residential properties in theory.

The option applies to the land on which a building sits and if demolished any subsequent property built on the site unless the owner specifically excludes the new building. They have provided a copy of their VAT 1614A form. But this is not the.

Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. New York State law allows local governments and school districts to give qualifying senior citizens up to a 50 reduction in the assessed value of their residential. The option to tax OTT allows a business to charge VAT on the sale or rental of non-residential property or in other words to make a taxable supply from what otherwise.

Options and pre-emption rights Adverse possession Transaction Management Contracts Trusts of land Commonhold Charities Land registration Investigating title Searches and enquiries Due. 2 rows A global option is a single option to tax which covers a large number of properties such as.

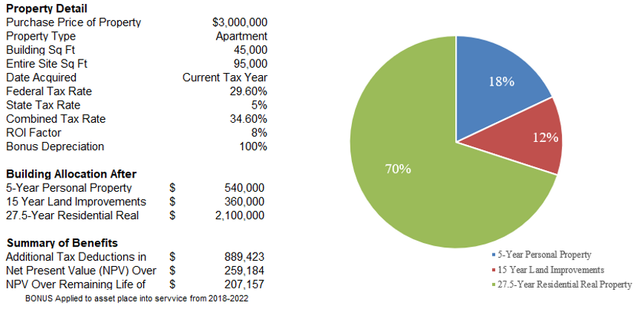

Residential Property Tax Solutions Corelogic

Property Taxes In Portugal The Ultimate Guide

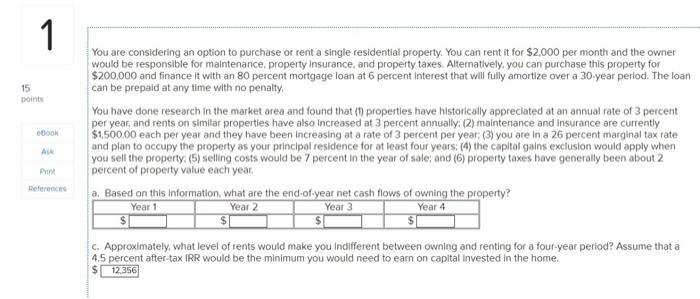

Solved You Are Considering An Option To Purchase Or Rent A Single Residential Property You Can Rent It For 2 000 Per Month And The Owner Would Be Course Hero

Getting To Grips With The Option To Tax Tax Adviser

:format(webp)/https://www.thestar.com/content/dam/thestar/opinion/contributors/2019/12/09/the-mathematical-truth-about-toronto-property-taxes-raising-them-is-the-best-option/toronto_houses_2.jpg)

The Mathematical Truth About Toronto Property Taxes Raising Them Is The Best Option The Star

Tax Exemption Error Boils Over Into Albany Mayoral Race

Value Added Tax And Property Lpc7309 Bcu Studocu

Sales Tax Consequences For Lease Options

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Commercial Property Tax Solutions Corelogic

Opting To Tax Land And Buildings For Vat What You Need To Know

How To Appeal Your Property Tax Assessment Bankrate

I Rent Property In Arizona And Need To Apply The Appropriate Tpt Rates The Auto Tax Function Doesn T Provide A Residential Rental Property Option Any Work Arounds

Solved 1 15 Ebook You Are Considering An Option To Purchase Chegg Com

Property Taxes Are Going Up What Homeowners Can Do About It

Buying Tax Lien Properties And Homes Quicken Loans

Developer Files Plans For Mixed Retail Residential Wilton Heights At Rts 7 33 Good Morning Wilton